Clarity that drives action.

Systems that unlock growth.

Financial clarity. Operational focus. Digital efficiency.

Speed up processes, reduce costs and increase margins – with smart simplicity.

How we bring value to your business

Pragmatic solutions, strategic support and operational precision - everything needed for control, efficiency and growth.

Financial discipline

We help you regain control over margins and cash-flow through concrete insights and practical tools that give effect already in the first weeks.

Efficient implementation

We introduce clear roles, flows and rhythm of work that enable faster implementation and greater responsibility, without bureaucratic ballast.

Smart tools

C-level Experience

How we work with clients

Our approach combines strategic clarity and operational precision.

Through carefully structured steps, we introduce order, a clear division of responsibilities and efficient tools, without unnecessary complexity. Our focus is on stable growth, better control and faster decision-making.

Financial discipline

In every cooperation, we introduce financial clarity first.

Together with the client we define budget, we map the key cash flows and we set up a simple system for cost tracking and margins.

Instead of theory - concrete numbers, formatted tables and routines that are applied week after week.

- A budget that follows the real needs of the business

- Regular monitoring of cash flows by weeks and months

- Categorization of costs for easier management and decision-making

- Financial insight available to management without dependence on accounting

Operational efficiency

We help teams streamline day-to-day operations, remove unnecessary complexity and function faster and more precisely.

We analyze workflows, definitions of responsibilities and management routines, and then introduce clear rules, tools and rhythm that bring measurable results.

We do not impose complex methodologies, but build on the existing strengths of the organization.

- Clearly defined roles and responsibilities for each team

- Efficient workflows without unnecessary steps

- Weekly and monthly rhythms of managing teams and goals

- Focused work and reduction of operational chaos

Smart technology choice

Technology is not the end, but the means.

Together we make rational decisions about the choice of tools that support growth, reduce errors and speed up daily work.

We do not propose solutions because they are "trendy", but because they make clear business sense, are simple to implement and easy to use, without constant dependence on external support.

- Technology in the function of increasing the speed and accuracy of work

- Tools that do not complicate but simplify everyday tasks

- Digitization without excessive costs and exaggerated promises

- An approach that starts from business needs, not from technology

Why clients hire Nonus Vis Advisory Group

Nonus Vis Advisory helps companies to establish financial clarity, predictable cash flow and more efficient day-to-day operations – without unnecessary complexity.

The firm operates at the intersection of finance, operations, and technology, with a clear focus on changes that management can see and feel in practice.

The founder of the company and the company's principal advisor, Mijat Ivović, graduated from the leading American business school at University of Southern California (USC) in Los Angeles, has over 20 years of experience in executive positions (CEO, CFO, COO) throughout Europe and the USA. He led companies in the fields of technology, services, production, and e‑commerce through transformations that brought concrete and measurable results.

When things start going

downhill – act fast

A crisis does not wait for you to be ready.

The pressure is mounting, decisions are piling up, and mistakes are costly.

Cash is disappearing

Operational chaos

Clients are leaving

Lack of decision-makers

What Our Customers Say?

Don't just take our word for it. Here's what some of our satisfied clients have to say about our financial solutions.

Heather Smith

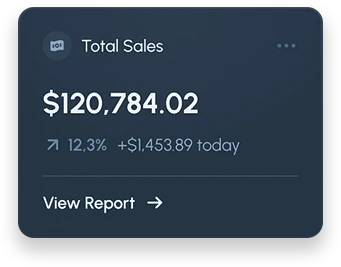

Increase in

customer growth rate

Jonathan Cheng

Daily savings

amount

Adam Sagiv

Increase in

customer growth rate